Last Friday offered itself as a solid day for bulls, the only thing it lacked was volume. All indexes gained, even the struggling ($IWM), although some of my individual stock plays haven’t enjoyed such gains.

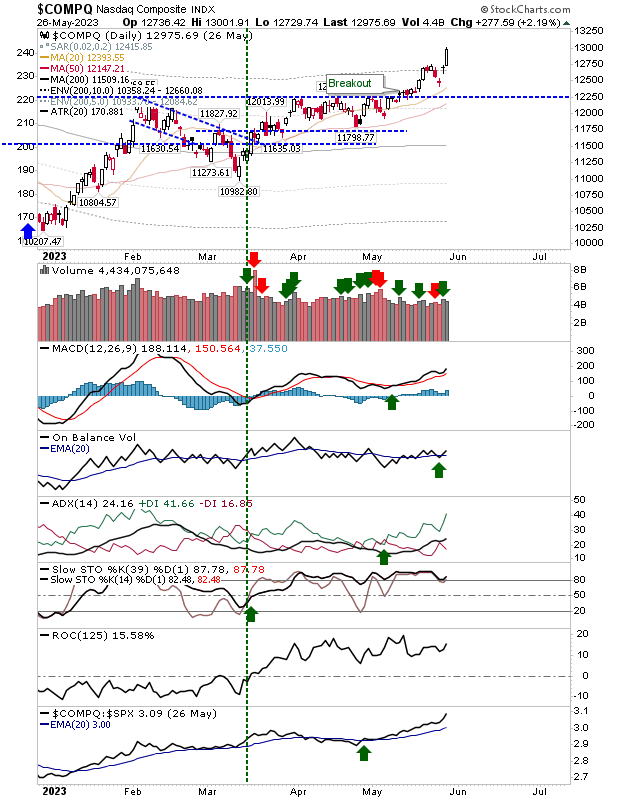

The enjoyed the best of the action as it built on its (now) well established breakout. It currently trades 12.7% above its 200-day MA, which by the table at the bottom of the post, is just shy of 15% of historic price extremes (and a time to take profits or sell a ‘covered call’). Technicals are net positive, and the index is accelerating in relative performance against the .

COMPQ Daily Chart

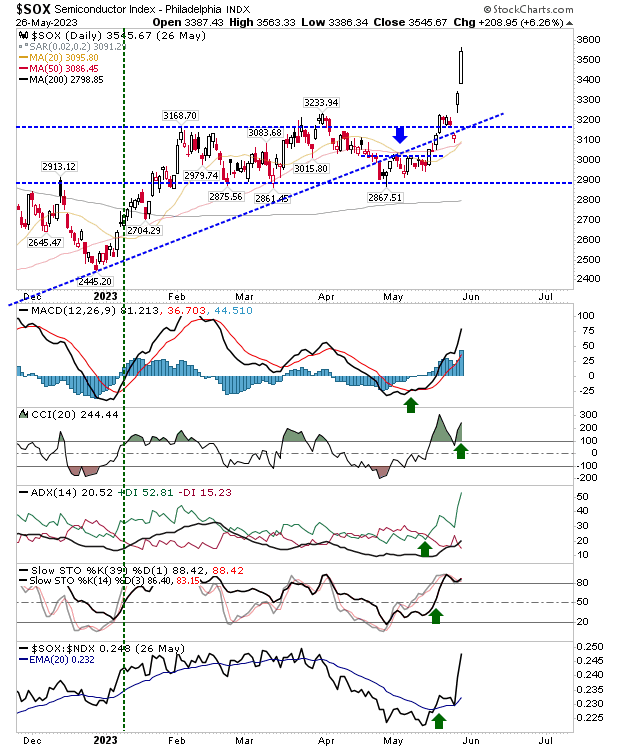

Powering the Nasdaq is the surge in Semiconductors (). As a business indicator, this is very bullish, and whatever economic woes lie on the horizon (recession) may be short-lived.

SOX Daily Chart

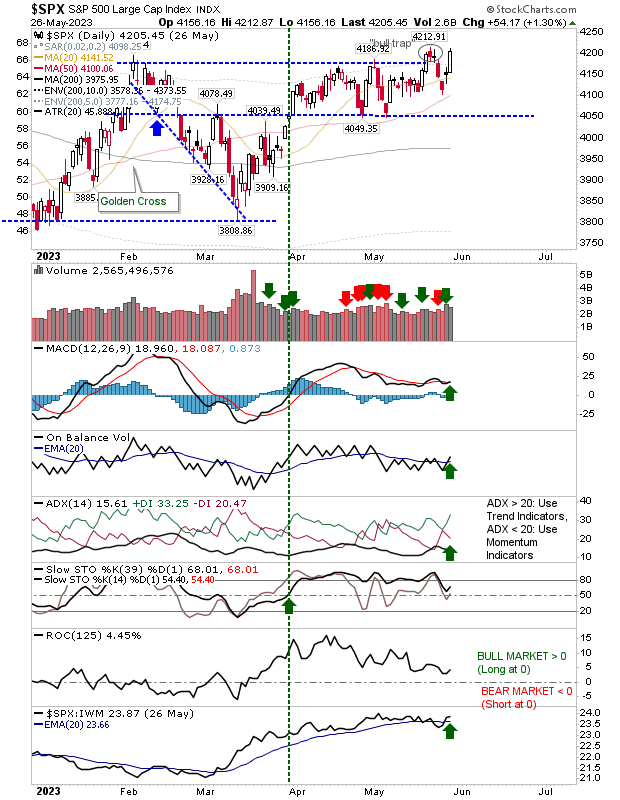

The S&P 500 is challenging the ‘bull trap’ from the previous week as technicals returned to a bullish stance. In particular, the MACD and On-Balance-Volume switched back to a ‘buy’, alongside earlier bullish signals in the ADX and a long-standing bullish signal in Stochastics.

SPX Daily Chart

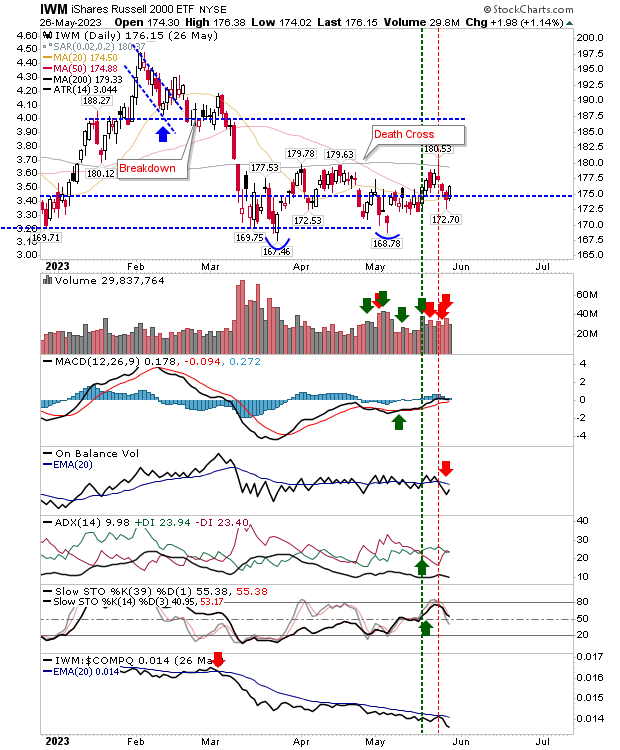

The Russell 2000 () enjoyed a more low-key day. What’s important for this index is holding on to 50-day MA support, at least until it can mount a challenge of its 200-day MA. Technicals are not as bullish as the Nasdaq and S&P 500, with On-Balance-Volume on a ‘sell’ trigger and a long-standing underperformance against the Nasdaq since March, But for now, we will take small victories.

IWM Daily Chart

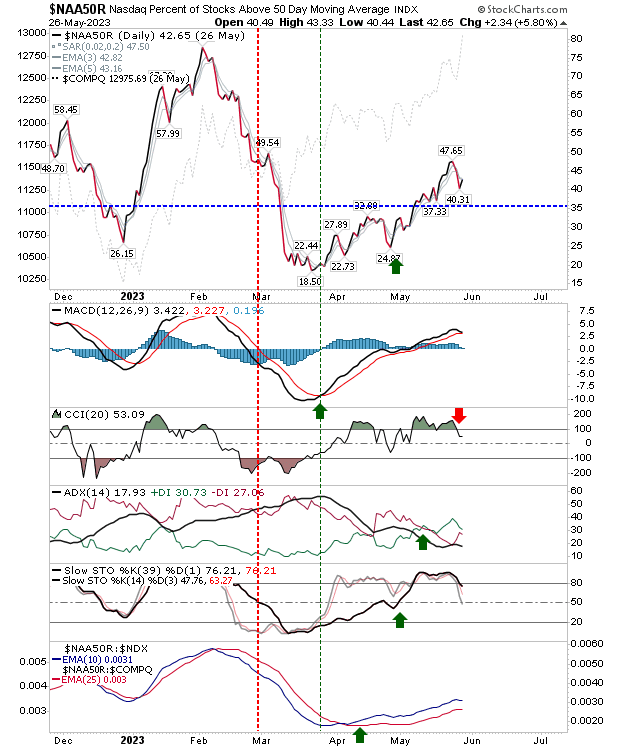

For the coming week, we want to see the S&P 500 clear (and negate) the ‘bull trap’ so bulls can focus attention on the Russell 2000. It’s likely because of the small sample size, but my personal holdings aren’t doing as well as the indexes suggest they should be. However, the percentage of Nasdaq Stocks above the 50-day MA is steadily rising.

NAA50R Daily Chart